1. Overview of the Chinese Maternal and Baby Nutrition Industry

Although the birth rate in China has declined in recent years, the market for maternal and baby nutrition products continues to expand. This is attributed to the increased spending power of families with babies and young children, as well as the elevated parenting concepts.

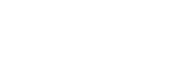

In 2022, the market size of the maternal and baby nutrition products in China reached 92.2 billion yuan, showing a year-on-year growth of 9.76%. The market sustained its growth in 2023, reaching 101.5 billion yuan. With the promotion of the three-child policy and the ongoing popularization of maternal and baby nutrition, the market size for maternal and baby nutrition products in China will further expand in 2024, estimated to reach 111.4 billion yuan.

*References: AskCI Report 2024

2. Current Chinese Maternal and Baby Nutrition Market

2.1 Latest Customer Demands

The latest consumer demands could be summarized into the following three aspects: safety enhancement, formula innovation, and breakthroughs in product presentation.

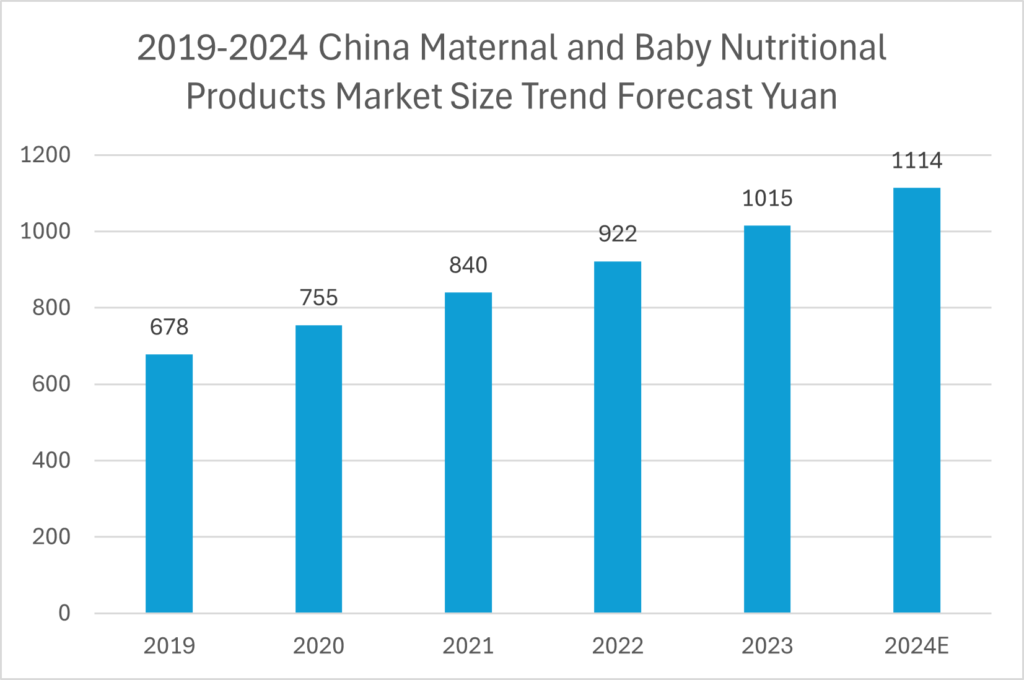

Based on emerging consumer trends, when selecting nutritional supplements, the maternal and baby demographic places significant emphasis on safety requirements. This notion of “safety” is not merely claimed by manufacturers. It requires endorsement from authoritative standards and clear ingredient data to support it. For instance, the “content of core nutritional elements” is a focal point of consumer concern.

*Source: JD Report 2023

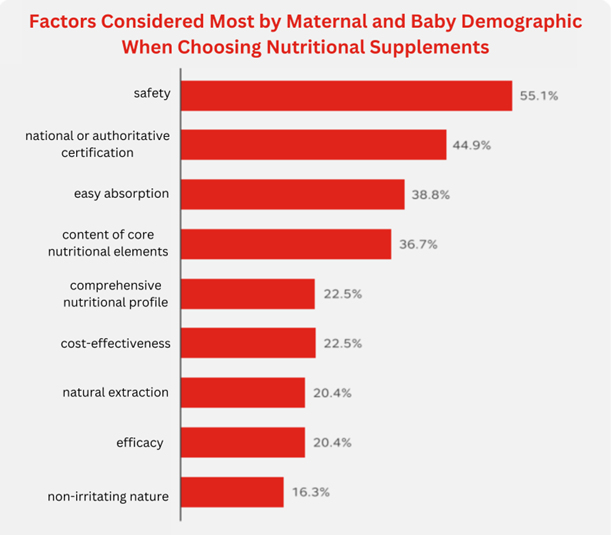

After meeting the basic nutritional supplementation needs, the maternal and baby demographic has higher expectations for the raw material formulation of products. 42.9% of the respondents hope for formulations without additional additives. 34.7% desire enhanced product functionality, 32.7% seek more portable packaging design, and 28.6% anticipate improved taste. Additionally, personalized customization, low calorie content, and high aesthetic appeal are also expectations of innovation in nutrition products from the maternal and baby demographic.

*Source: JD Report 2023

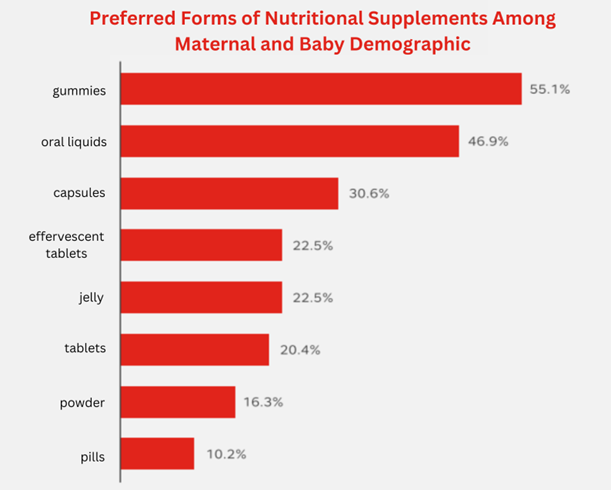

In the past, nutritional supplements were predominantly presented in the form of pills, capsules, and other medicinal formats. However, the new generation of consumers has more diversified demands for the presentation of maternal and baby nutritional products, requiring a blend of healthiness, deliciousness, and amusement. Shifting from traditional pharmaceuticals to functional snacks, the overall trend in nutritional products is towards “lifestyle integration.” Innovative forms such as gummies, effervescent tablets, and jelly, are highly favored by consumers, further propelling the transformation of the maternal and baby nutrition product market.

*Source: JD Report 2023

2.2 Customer Purchasing Channels

With the diversified development of purchasing channels, the proportion of online purchases is gradually increasing. In 2021, offline consumption channels for maternal and baby products in China accounted for 66.2%. Maternal and baby product purchases are still predominantly made through offline channels. The purchasing channels for maternal and baby nutritional supplements diversify, while e-commerce platforms pay more attention to and expand their offerings in this category. However, the range of brands and product categories available online is becoming increasingly abundant. This has led to a year-over-year rise in the proportion of online consumption channels. Moreover, online channels possess strong social sharing attributes, allowing consumers to share their preferences and enabling brands to quickly gain user feedback. The proportion of online channels in the maternal and baby nutritional product consumption market will continue to increase in the future.

*Source: iResearch report 2023

3. Potential Future Trends of the Chinese Maternal and Baby Nutrition Industry

3.1 The industry is moving towards a more refined age-based categorization.

Currently, the maternal and baby nutrition market lacks age-specific products. Most offerings are broadly categorized under labels such as “children” or “pregnant women.” It overlooks the nuanced requirements of babies at different stages. Therefore, consumers have to determine the appropriate age and dosage of nutrients for their babies during the purchasing process. While some leading maternal and baby nutrition brands have introduced age-specific product matrices, the market as a whole lack a comprehensive age-based layout. In the future, brands will increasingly prioritize addressing the specific needs of babies at different developmental stages. The importance of the product innovations is emphasized. The trend towards user-centric refinement is shaping the industry. It is essential to explore and apply age-based layouts for innovative solutions.

3.2 The categories are becoming more diverse.

Consumer preferences for maternal and baby nutrition products are shifting towards greater convenience and specificity. The maternal and baby nutrition products market is experiencing a phase of diverse development. It values the snacking, ready-to-eat, and graded refinement of nutrition products for mothers and babies.

3.3 Products are becoming healthier and more efficient.

The rising demand for maternal and baby nutrition products is prompting companies in this sector to prioritize the healthiness of ingredients, the efficiency of nutrition content, and the diversification of product functions. Companies are expanding the functionalities of their products and developing items tailored to specific baby needs. Furthermore, maternal and baby nutrition companies are enhancing the quality and nutrition value of their products through rigorous research on ingredients and functions. It aims to offer consumers healthier and more efficient product choices.

*References: AskCI Report 2024

Keywords:

| CBME 2024 baby care essentials expo[7] |

| CBME 2024 baby gear innovations[8] |

| CBME 2024 eco-friendly baby products[9] |

| CBME 2024 wholesale baby merchandise[10] |