Magic Mirror’s data reveal that in 2023, the baby care market on major e-commerce platforms was worth 13.19 billion yuan, a 3.7% increase from the previous year. However, the market’s growth is slowing and needs a significant boost.

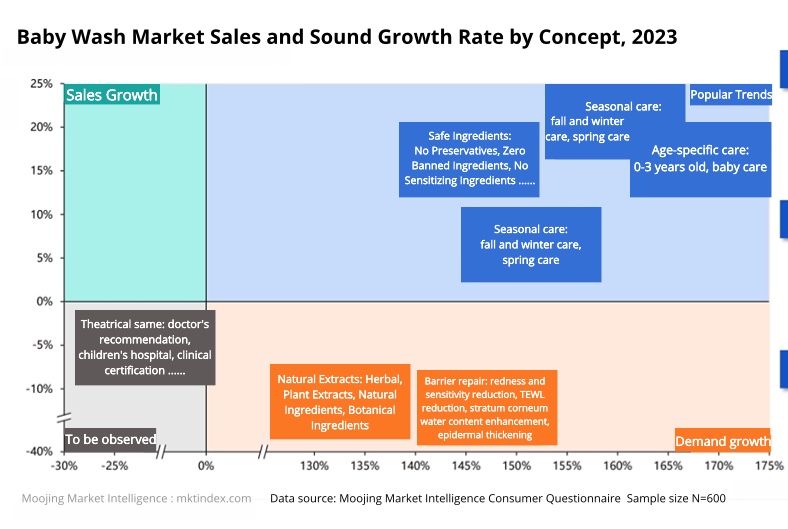

As post-90s and Gen Z individuals become parents, their distinct consumption habits and lifestyle preferences are impacting the maternal and child market. The idea of scientific skincare has expanded into baby care. The popularity of “barrier repair” for babies is surging on social media, with a 142% year-on-year increase in related discussions.

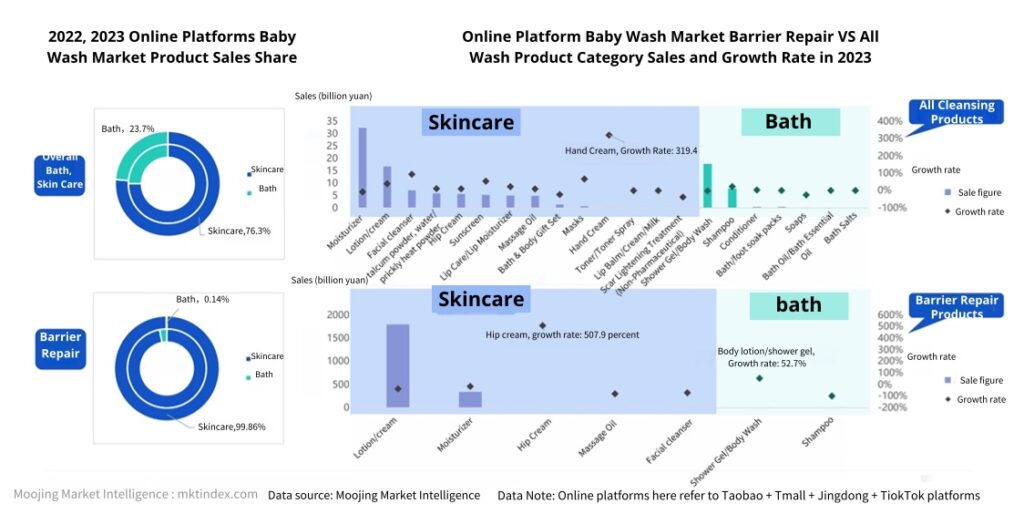

Barrier repair for babies is crucial for parents of kids aged 0-3, yet this widespread need is underserved. In 2023, online sales of these products were just 0.2 billion yuan with 101,000 units sold, making up a mere 0.16% of the baby care market. This indicates that babies barrier repair is an untapped market with less competition, offering brands significant innovation opportunities.

It is a blue ocean market ripe with opportunities. The question arises: where can baby skincare brands find innovation and gain growth? Magic Mirror’s report offers a detailed analysis to guide these brands in capitalizing on these opportunities. The insights presented are drawn from Magic Mirror Insight’s “Baby and Child Skin Barrier Repair White Paper.”

– Consumer survey: consumer questionnaire with a sample size of 600

01) Baby Skin Care Market Consumer Research

Target Consumer Profile

The primary caregivers for children aged 0-3 are well-educated, high-earning women aged 25-35. Their education promotes a rational, scientific approach to childcare, while their income provides greater flexibility and choice in care options.

As far as the portrait of babies aged 0-3 years old is concerned, baby skin problems are frequent, and the major skin problems vary from age to age.

Skin problems are most prevalent among babies in second-tier cities, affecting 61.1%, compared to a lower rate in third-tier and smaller markets.

Core Consumer Needs

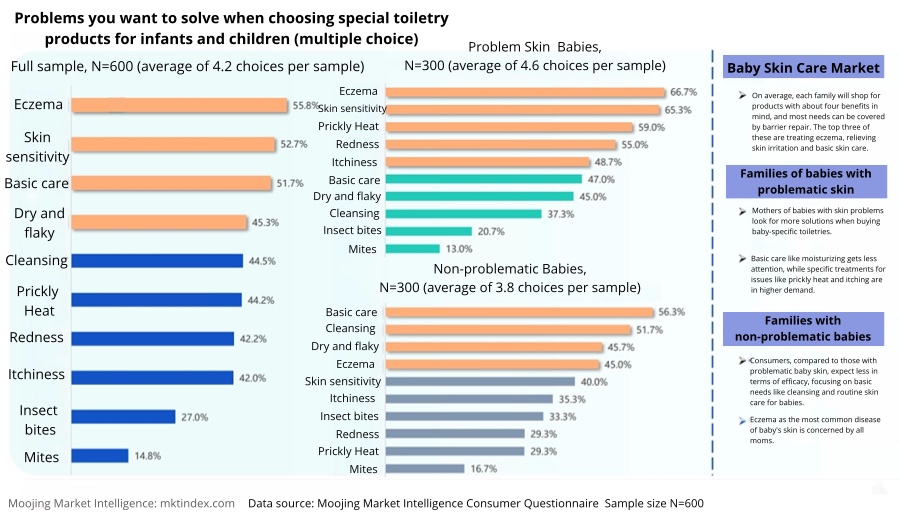

Among the baby skin issues that concern mothers, prickly heat, allergies, and eczema (like milk and drooling rashes) are the top three, causing babies to scratch and cry.

In addition, different age groups of babies have different skin problems. 0-1 years old is mainly diaper rash, 1-3 years old is mainly prickly heat, allergy problems throughout the 0-3 years old baby’s whole stage.

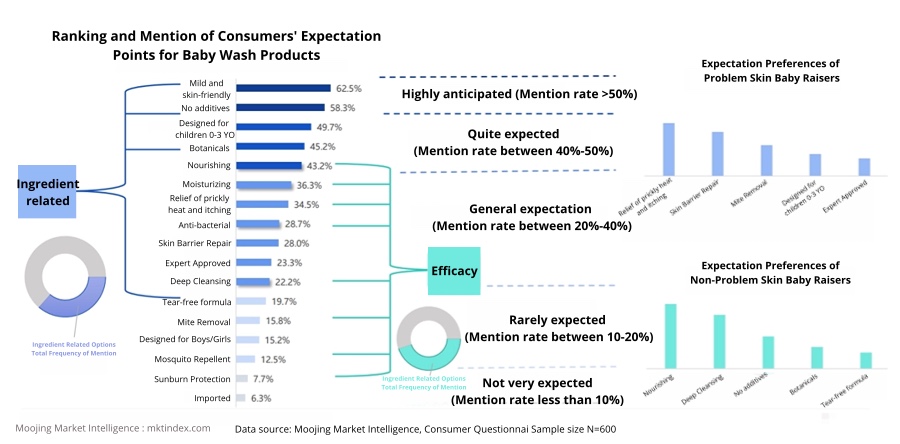

Therefore, parents prioritize the efficacy of products when making purchases, with ‘moisturizing’ and ‘hydrating’ effects being the top concerns. Both of these belong to the basic skincare needs. The expectation for ‘sun protection’ is relatively low. However, when looking more closely, the highest consumer expectations are for ‘gentle on the skin’ and ‘additive-free,’ both of which are closely related to product safety.

Additionally, on average, each family considers about four types of effects when selecting products, most of which can be covered by barrier repair. The top three priorities are treating eczema, relieving skin irritation, and providing basic skin care.

In contrast, parents of babies with sensitive skin have higher expectations for product efficacy. Beyond relief from prickly heat and itching, they highly value skin barrier repair. They also place more importance on age-appropriate care and expert certification.

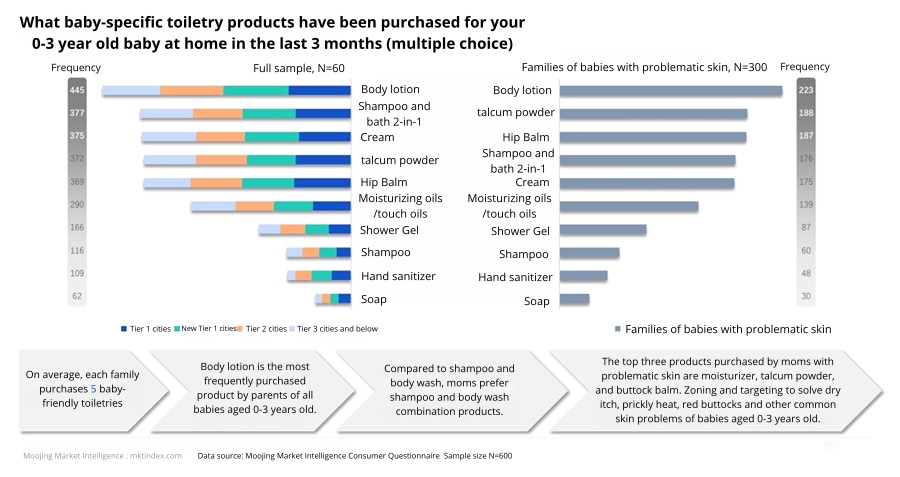

Babies under 1 year old, their skin are too delicate and relatively simple to clean and care for. Thus, mothers prefer to purchase ‘combination’ products (for example, those that serve both as shampoo and body wash). Families with babies aged 1-3 years, as well as those with babies having problematic skin, place a higher emphasis on the refinement of skincare and prefer products designed for zoned care.

The top three products for babies with problematic skin purchased by mothers are moisturizer, talcum powder, and buttock balm. Zoning targeted to solve dry itching, prickly heat, red buttocks and other common skin problems of babies 0-3 years old.

Data indicates that the concepts of seasonal, age-specific, and zonal care are popular on social media and with consumers, with sales up by 18.2%, 18.3%, and 8.9% respectively.

Purchase Channel

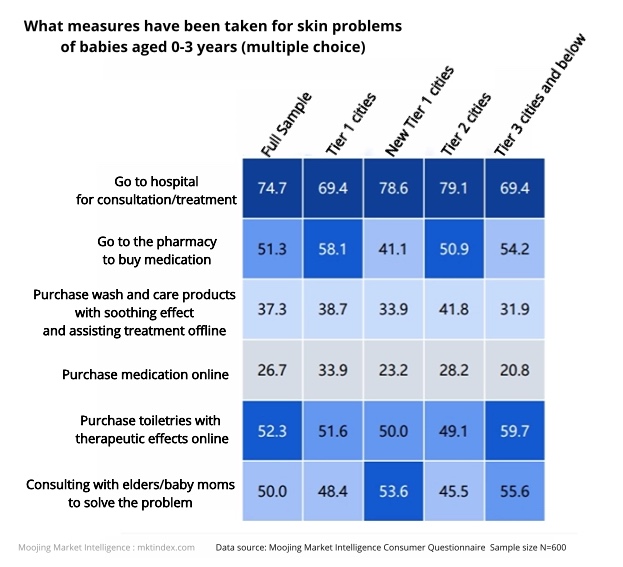

When babies aged 0-3 face skin issues, parents first turn to the hospital. Beyond medication, they also prefer buying scrubs online that soothe and aid in treatment to address the problem.

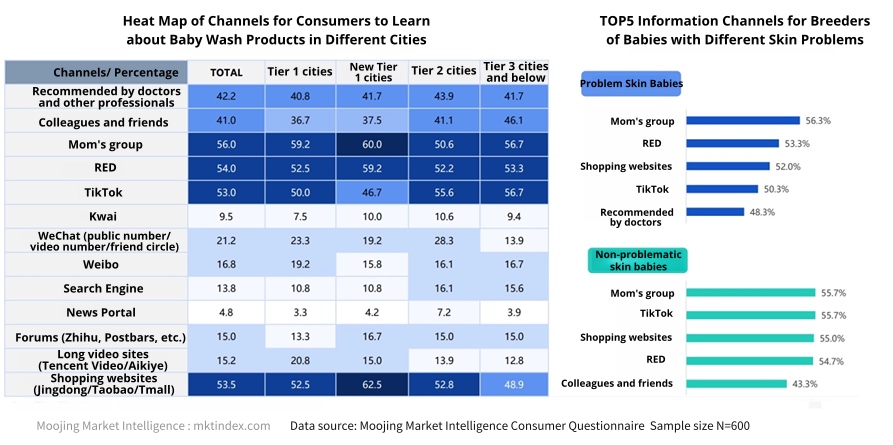

“Mom’s groups” are key info sources for new parents, acting as private hubs for traffic. Discussions often cover baby skincare issues and product recommendations.

As a popular social media software, Xiaohongshu and TikTok are even more important than professional traditional e-commerce platforms among mothers. Mothers will take the initiative to do their homework on product information before purchasing after being recommended. At the same time, contemporary mothers approach parenting with a more scientific mindset. Particularly, mothers of babies with problematic skin are more inclined to heed the recommendations of professionals such as doctors.

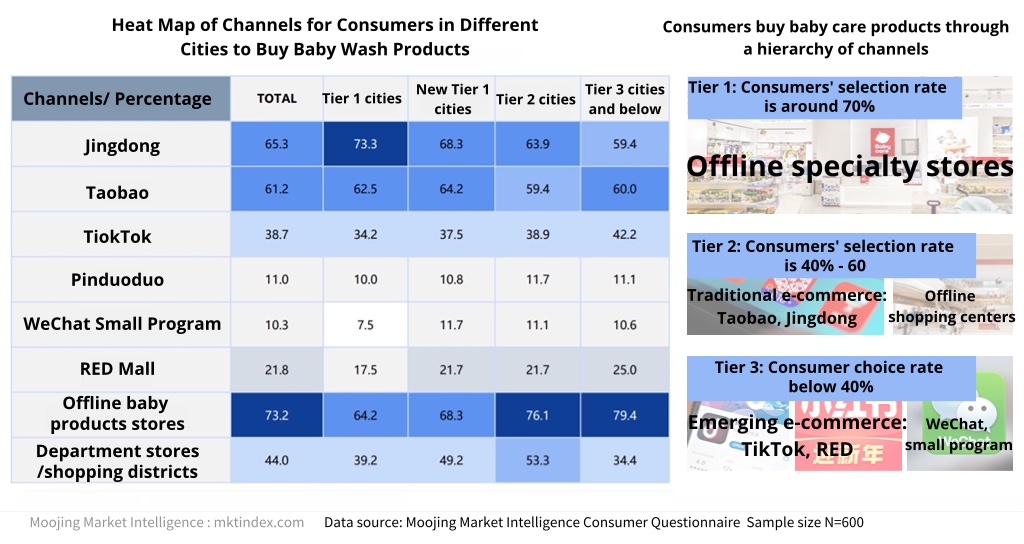

Overall, offline baby stores are the preferred channel for consumers to buy baby care products, followed by Jingdong and Taobao. However, consumers in different levels of cities have different channel preferences, with Jingdong preferred in first-tier cities and offline purchases preferred in sinking cities.

Comparing the information acquisition channels, the mom’s group on WeChat has the highest usage rate, but very few go through the WeChat channel when purchasing. TikTok and Xiaohongshu are more of a source of information for consumers.

02) Baby Barrier Repair Track Insights

In the face of widespread consumer demand, how is the baby barrier repair market performing?

According to Magic Mirror Analytics+ data, the concept of “barrier repair” is mainly found in the skin care category, which accounted for 76.3% of sales in 2023, a slight increase from 2022.

Among them, lotions, creams and moisturizers are the main categories with high frequency of daily use, occupying more than 99% of the online market share.

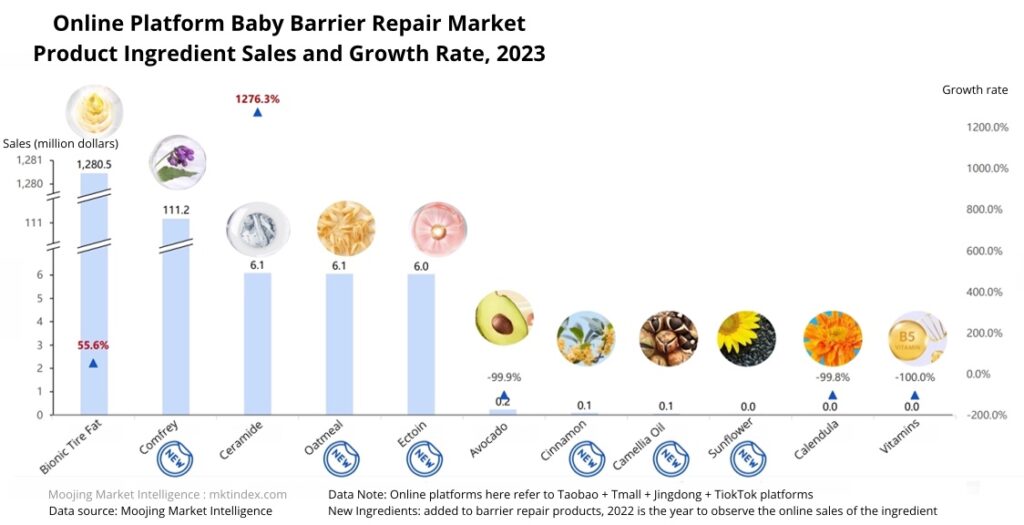

In the main barrier care baby care products, “bionic lanolin” is the top ingredient by market volume, with 2023 sales over ten million yuan and a 55.6% growth rate. While “ceramide” has the highest growth rate, its market volume is much smaller, at the ten thousand yuan level, and other non-new ingredients are seeing negative growth.

Among new ingredients, “comfrey” has the largest market volume. Known for its anti-irritant and anti-allergic properties, comfrey’s soothing effects make it a favored ingredient in many barrier care products.

On the brand side, consumers prefer to buy the same brand of toiletry matrix products, especially for babies with problematic skin.

Nearly 60% of consumers prefer to purchase baby care products from the same brand. First-tier city consumers favor a single brand’s product range, whereas those in third-tier and lower cities tend to mix and match products from different brands.

Looking at the age distribution of babies, those aged 0-2 years, due to their delicate skin, have a higher cost associated with trying and potentially making mistakes with cleansing and care products. As a result, they parents tend to prefer buying products from the same brand. In contrast, babies aged 2-3 years, whose skin is maturing, allow caregivers to start experimenting with products from a variety of brands.

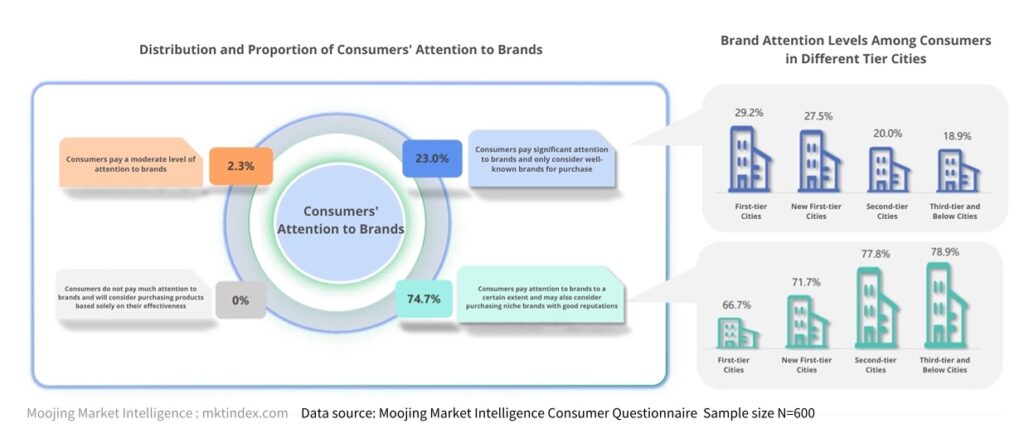

Consumers care significantly about the brand of baby care products, with only 2.3% not concerned about it. Over 90% are concerned with the brand, and 74.7% value the brand while also considering its reputation and strength, not just brand awareness.

Consumers in first-tier cities focus more on brand awareness, while those in sinking cities prioritize a brand’s reputation and strength.

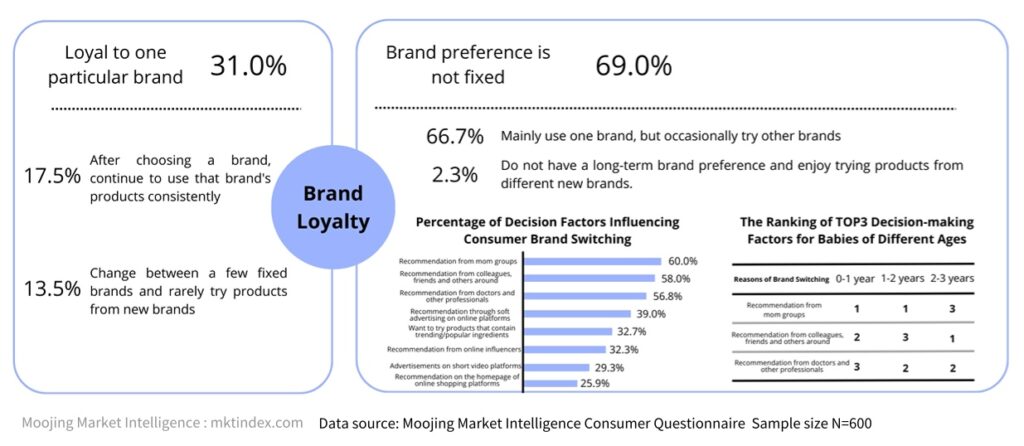

Moreover, 69.0% of consumers switch toiletry brands due to various decision factors. The top three influencers for brand change are mom groups, friends/colleagues, and doctors/professionals, with the first two being private traffic influences and the third being authoritative.

Additionally, the top three decision factors differ among various baby age groups. Consumers of 0-2 year old babies more inclined to pick wash and care products recommended by mom groups.

Keywords: