Introduction

Chinese consumers’ demand for nutrition has been on a remarkable upward trajectory, driven by increased health awareness and rising consumption power. The nutritional products industry in China is expected to reach an impressive CNY 355.4 billion by 2024, with significant potential for further development. Within this landscape, the maternity and baby nutrition market stands out for its robust growth, particularly in the sector of maternity and baby nutritional supplements.

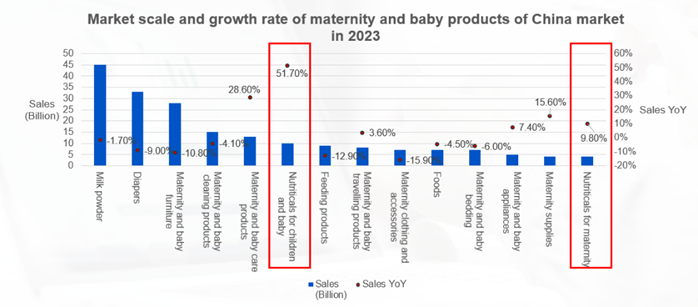

China’s maternity and baby nutrition market maintains high growth. Among all types of maternity and baby products, maternity and baby nutrition products have the fastest growth, with year-on-year growth rates of 52% and 9.8%.

1. Market Trends of Imported Nutrition in China

Rapid Growth of Maternity and Baby Nutritional Supplements

Among the various segments of maternity and baby products, nutritional supplements are currently the fastest-growing category. These products are designed to provide essential nutrients for expectant and new mothers, as well as infants and young children aged 0 to 6 years. This demographic is particularly vulnerable and requires a balanced intake of nutrients to support healthy development during crucial early stages.

Safety as a Key Factor

Safety has emerged as a pivotal factor influencing purchase decisions for maternity and baby nutrition products. Recent food safety scandals in China have eroded consumer trust in domestic brands, leading mothers to gravitate toward imported foreign brands, which are perceived to offer higher safety standards and quality assurance. As a result, overseas nutrition brands are poised to become a significant trend in the development of this category.

Despite the increasing popularity of domestic brands, the imported sector is expected to dominate the market. Notably, during Tmall’s 2022 Double Eleven sales event, all top 10 best-selling maternity and baby nutritional products were from overseas brands. This trend underscores the sustained consumer preference for imported goods that promise safety and quality.

Top 10 sales of maternity and baby nutrition brands on Tmall Double Eleven in 2022

| Brand | Origin | |

| Top 1 | INNE | German |

| Top 2 | Bio island | Australia |

| Top 3 | Eric Favre | France |

| Top 4 | Nemans | USA |

| Top 5 | Childlife | USA |

| Top 6 | Nature’s Way | Australia |

| Top 7 | BIOSTIME | France |

| Top 8 | Swisse | Australia |

| Top 9 | Ddrops | Canada |

| Top 10 | Witsbb | Australia |

2. Consumer Preferences in the Nutrition Industry

Knowledgeable Consumers

Today’s pregnant mothers are well-informed about the various maternity and baby nutritional products available on the market. Research indicates that over 90% of pregnant and postpartum women possess a solid understanding of these products. They actively seek information through diverse channels, primarily online. Popular sources include maternity and baby-related apps, websites, social media platforms, content communities, e-commerce sites, and short video platforms. Notably, more than 50% of respondents rely on these digital channels for information, highlighting the shift towards online engagement.

Balanced Nutrition Awareness

Pregnant mothers exhibit a keen interest in achieving balanced nutrition, making them highly receptive to various maternity and baby nutritional products. When selecting supplements, mineral supplements are the most favored, followed closely by vitamins and specialized nutrients such as DHA and dietary fiber. This preference for essential nutrients illustrates a broader awareness of the importance of maternal and infant health.

3. New Consumer Demands: Safety Upgrades and Innovative Formulations

Elevated Safety Needs

As the market evolves, consumers are increasingly prioritizing safety when purchasing nutritional products for maternity and baby care. This demand for safety extends beyond mere certifications; consumers expect clear and transparent ingredient data. The core nutritional element content has become a focal point of consumer interest, with many seeking assurances that products contain no unnecessary additives.

Preferences for Innovation

In addition to safety, mothers are expressing heightened expectations regarding product innovation. Recent surveys reveal that 42.9% of respondents desire formulations devoid of additional additives, while 34.7% seek enhanced product functionalities. Furthermore, 32.7% of consumers advocate for more portable packaging designs, and 28.6% prefer improved taste. Personalization, lower calorie options, and appealing aesthetics are additional attributes that mothers are increasingly looking for in nutritional products.

Conclusion

In summary, the maternity and baby nutrition market in China is characterized by its rapid growth and evolving consumer demands. As mothers become more health-conscious and discerning, the market is shifting toward imported brands that prioritize safety and quality. With a well-informed consumer base actively seeking balanced nutrition and innovative formulations, the future of the maternity and baby nutritional products industry looks promising. Brands that can adapt to these trends and meet the growing expectations of consumers will likely thrive in this competitive landscape.

| maternity expo 2024 baby nutrition seminars[1] |

| CBME 2024 baby nutrition and health[2] |

| CBME 2024 maternity and baby product awards[3] |