China Social Media Market Overview

Due to factors like increased internet users, widespread mobile internet access, and the rise of social e-commerce, China’s social media market is poised for continued rapid growth in the coming years. Statistics show that from 2015 to 2021, the market size of social media platforms in China surged from 42.17 billion yuan to 192.65 billion yuan. By 2022, it’s estimated to reach 233.43 billion yuan, with mobile social media driving faster growth.

Why should baby and maternity brands engage in social media marketing?

China’s social platform market is continuously expanding and innovating, with major platforms including WeChat, Douyin, Weibo, RED etc., boasting user numbers in the hundreds of millions. Particularly noteworthy is the rapid growth of short video platforms, making them a highlight in the market.

The scale of maternity and baby content platform is growing rapidly, and digital marketing is gradually playing a significant role. Brand investment continues to grow, and content platforms are becoming an important marketing position. According to survey data, more than 50% of maternity and baby brands will have their marketing budgets remain flat or increase in 2022. Among them, the figure for emerging maternal and infant brands within 5 years exceeds 70%.

With the increase in brand investment and the awakening of user content consumption awareness, the scale of maternity and baby content has significantly increased. According to statistics from the new list, regarding on Douyin, Kuaishou, Red, and WeChat video platforms, in April 2023, the total amount of maternity and baby-related content more than doubled year-on-year. At the same time, visitos’ willingness to interact has also increased in a great deal. The total number of likes for maternity and baby content platforms increased nearly 1.5 times.

Main social media platforms in China

Comparison of Social Media Platforms in China

| Feature/Platform | Douyin | Little Red Book | |

| Active users | 1.25 Billion | Billions | Hundreds of millions |

| Content Format | Official account articles, short videos | Short videos | Posts |

| User Demographics | Broad | Young generation | Young, fashionable audience |

| Creator Tools | Rich | Abundant creator tools | Emphasis on user-generated content |

| Features | Mini-program ecosystem | Popular music attracts young users | Emphasis on authenticity and diversity |

| Commercial Applications | Official Video Account | Advertising, live e-commerce | Advertising, brand e-commerce |

Introduction of major social media platforms in China

- WeChat

WeChat is China’s most powerful social media platform with an extensive list of features. Its ecosystem is comprehensive, integrated, and indispensable. Its seamless integration allows users to share moments, follow celebrities and brands, order food, schedule appointments, play games, transfer money, pay bills, receive coupons, and message others—all within the app.

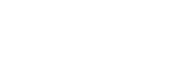

The WeChat Ecosystem

Tencent has created a vast, interconnected ecosystem, making WeChat more than just a collection of standalone features. WeChat has transformed from a basic messaging app into a comprehensive lifestyle platform. Leaving home without it is like forgetting your keys.

| Icon | Description |

| Channels are algorithmically driven short videos, providing a rare opportunity to reach new audiences inside the WeChat ecosystem. |

| WeCom is a great way for customer-facing staff to create communities and build hightouch individual relationships with customers. |

| Official Accounts can publish articles more frequently, showing up in your follower’s dedicated Official Accounts feed. |

| WeChat Pay lets you collect money from customers online and offline. |

| Search is a key part of discovery within WeChat. Consumers can find your Official Account, articles or videos you’ve published. |

| Mini Programs provide rich app-like functionality, including ecommerce conveniently integrated within WeChat. |

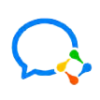

- Douyin

Douyin, often dubbed as “the Chinese TikTok,” is distinct from its counterpart despite both being presented by Bytedance as similar platforms. Douyin originated in 2016, while TikTok emerged in 2018 as a rebranding of Musical.ly, a short-video app acquired by Bytedance a year prior.

Source: The Ultimate Guide To China Social Media Marketing 2022 KAWO

The comparison between Douyin and Tiktok

| Feature | Douyin | TikTok |

| Availability | Chinese app store, requires Chinese number | Overseas versions of app stores |

| User Access | Limited to Chinese users | Limited to users outside China |

| Content Accessibility | Inaccessible between Douyin and TikTok | Inaccessible between TikTok and Douyin |

| Additional Features | Better livestreaming, ecommerce, geotagged services (POI) | / |

| Video Length | Up to 15 minutes | Limited to 3 minutes |

| Professional UGC (PUGC) | Higher presence on Douyin | Less prominent on TikTok |

| Content Style | Resembles content on YouTube | Suitable for memes and challenges on TikTok |

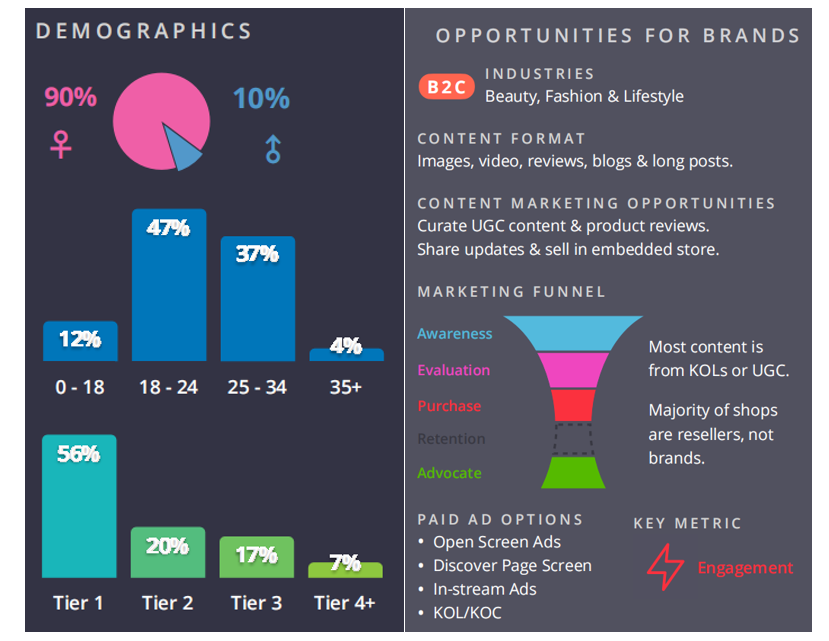

Little Red Book (RED)

Little Red Book (RED) is the home of beauty and fashion shopping for China’s consumers. While many hail it as an ecommerce platform, REDs true strength lies in the user generated content it hosts, thus serving more as a discovery platform. As the Little Red Book platform community grew, the content also went through changes – product descriptions became more creative. Some Little Red Book content creators started becoming recognized for their unique tone of voice, and thus became key opinion leaders

Source: The Ultimate Guide To China Social Media Marketing 2022 KAWO